Decision-making in the world of business always includes consideration of two questions: (1) What the tax implications may be and (2) How to best allocate available resources. With respect to these two questions, the purpose in this article is to address the answers as they apply to one particular construction process … dealing with aged/discolored acoustical ceilings in a commercial property remodeling project.

Utilizing the most current technology, ceiling restoration and ceiling betterment are the same. This is true because the ceiling (an asset), once restored, is made better by:

- Extending the ceiling’s life cycle

- Improving the acoustics (sound absorption)

- Increasing fire rating

- Lowering toxicity level

- In white color, increasing the light reflectance levels

- Reducing smoke development (should there ever be a fire)

From an accounting perspective, capital expenses can be spread over time. Therefore, in the commercial sector, it is generally preferable to do so. In what follows, it will be shown that funds spent on the restoration of acoustical ceilings is a capital expenditure.

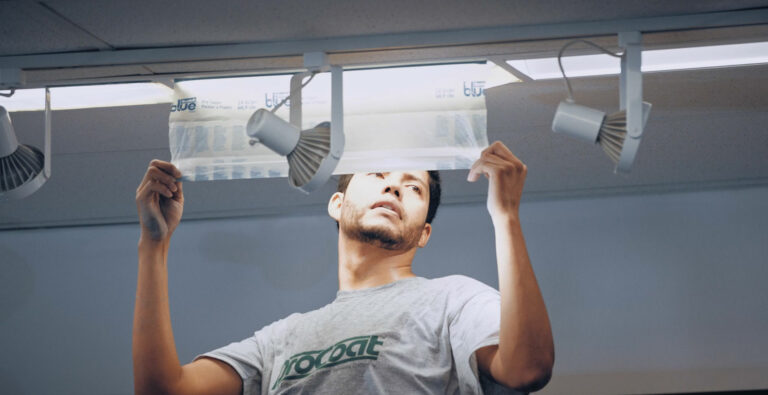

Restoration

With respect to acoustical ceilings, the restoration technology has continued to be perfected through the years to the extent that it is no longer just a means of avoiding replacement with new materials that is the attraction. To the contrary, the most advanced technology is so well refined that a restored ceiling surface can out-perform that of new materials.

With all of this as background, let’s look closer at the question of whether ceiling restoration is a capital expenditure. When the ceiling was initially installed it became an asset. With respect to the definitions just cited, ceiling restoration improves the useful life of an existing capital asset.” It does that by virtue of the bulleted improvements cited in the second paragraph of this article.

Thus, it would appear the answer is, yes.

Cost Savings of Restoration

Once the capital expense issue is established, other financial benefits of the restoration approach become icing on the proverbial cake. Typically, it costs less than one-half that of replacement with new materials and is completed in one-third of the time. Particularly when considering project time, this can represent a significant budget number. Add to it the positive environmental benefit of not contributing old materials to the land-fills and it becomes a much easier option to adopt.

Author’s Note: This article is providing readily available information as it applies to one specific process and should not be viewed as offering any tax recommendations. Formal accounting decisions should be made in cooperation with one’s tax consultants in light of what has been shared herein. The purpose of the above information is merely to provide additional data to help make an informed decision and evaluation.